maine excise tax rates

Rate of excise tax. The primary excise taxes on fuel in Maine are on gasoline though most states also tax other types of fuel.

Which U S States Charge Property Taxes For Cars Mansion Global

Purchase price subject to salesuse tax line A minus line D E.

. 7 on-premise sales tax. HOW MUCH IS THE EXCISE TAX. MSRP manufacturers suggested retail price Newer vehicles will generally be more expensive to excise than older vehicles.

For example if your vehicle has an MSRP of 8950 and a milage rate of 0065 you will. Electronic Request Form to request individual income tax forms. We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the amount of tax reimbursement to each town for veteran homestead and animal waste facility exemptions and tree growth tax loss reimbursement.

The amount of tax you pay depends on two things. Tax Year Assessed CFET Rate per acre Acres FPD actual expenditures CFET Budget Net CFET Tax Revenue. To calculate your estimated registration renewal cost you will need the following information.

The age of the vehicle 2. Visit the Maine Revenue Service page for updated mil rates. Sparkling wine 125gallon.

1258 would have doubled the excise tax on cigarettes to 400 a pack. Real Estate Withholding REW Worksheets for Tax Credits. Calculation will be based on.

When a vehicle needs to be registered an excise tax is collected during the registration. The rates drop back. Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax.

Boat Launch Season Pass - Piscataqua River Boat Basin. Number of gallons included in line A above B. 2017 Older -- 400 per 1000 of value.

Neither bill passed but both have carried over to this years session and HP 1258 will be heard by the Health and Human Services Committee in February. The age of the vehicle 2. An excise tax is imposed on the sale or transfer of marijuana from a commercial marijuana cultivation facility to a retail marijuana store and from a commercial marijuana cultivation facility to a marijuana product manufacturing facility.

The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. 2022 Maine state sales tax. Watercraft Excise Tax Requirement.

2019 -- 1000 per 1000 of value. Maine calculates this tax by taking the current MSRP of your vehicle and multiplying it by the mileage rate. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below.

How much is the Excise Tax. Please note this is only for estimation purposes -- the exact cost will be determined by the city when you register your vehicle. The amount of tax you pay depends on two things.

Over 155 sold through state stores. Mil rate is the rate used to calculate excise tax. The excise tax on cultivators is 335 per pound of flowers 94 per pound for trim 150 per pound for seedlings and 35 cents per pound for seeds.

A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Groceries and prescription drugs are exempt from the Maine sales tax. Maine imposes excise taxes on various forms of marijuana being transferred between licensees in the state such as cultivators dispensaries and wholesalers.

Below you will find the Town of Eliot Boat Excise Tax Payment Form for downloadcompletion along. 2022 -- 2400 per 1000 of value. Maine Aviation Fuel Tax In Maine Aviation Fuel is.

State Federal Excise Tax Paid Gallons on line B times rate on line C D. 2020 -- 1350 per 1000 of value. During last years legislatures special session in Maine two bills HP.

Cultivators will pay a 335 per pound excise tax on flowers and mature plants and a 94 per pound tax on trim. Maine excise tax has been paid A. YEAR 1 0240 mil rate YEAR 2 0175 mil rate YEAR 3 0135 mil rate YEAR 4 0100 mil rate YEAR 5 0065 mil rate YEAR 6 0040 mil rate.

Departments Treasury Motor Vehicles Excise Tax Calculator. The excise tax due will be 61080. 2021 -- 1750 per 1000 of value.

As of August 2014 mil rates are as follows. In Maine wine vendors are responsible for paying a state excise tax of 060 per gallon plus Federal excise taxes for all wine sold. Each commercial marijuana cultivation facility shall pay an excise tax at the rate of 15 on marijuana that is sold.

Refundable excise tax rate G. Immature plants and seedlings will also be taxed at the rate of 150. 16 rows 1 CNG Hydrogen and Hydrogen CNG tax rate is applied to every 100 cubic feet.

SalesUse tax due line E times 055 F. Counties and cities are not allowed to collect local sales taxes. Exact tax amount may vary for different items.

HOW IS THE EXCISE TAX CALCULATED. 2022 Watercraft Excise Tax Payment Form. Excise tax is paid at the local town office where the owner of the vehicle resides.

Spinney Creek Tide Gate Schedule - 2021. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55. MSRP manufacturers suggested retail price Newer vehicles will generally be more expensive to.

Excise Tax Rate C. 2018 -- 650 per 1000 of value. Share this Page How much will it cost to renew my registration.

This information is courtesy of Larry Grant City of Brewer Maine The same method will be used to calculate the fees to re-register the same vehicle.

Excise Tax Information Cumberland Me

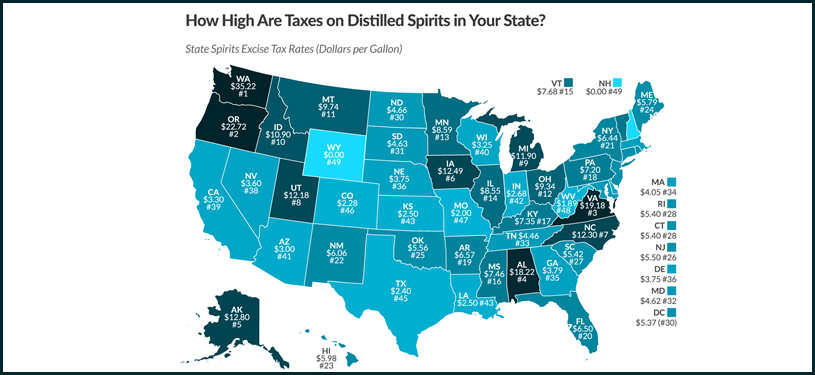

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

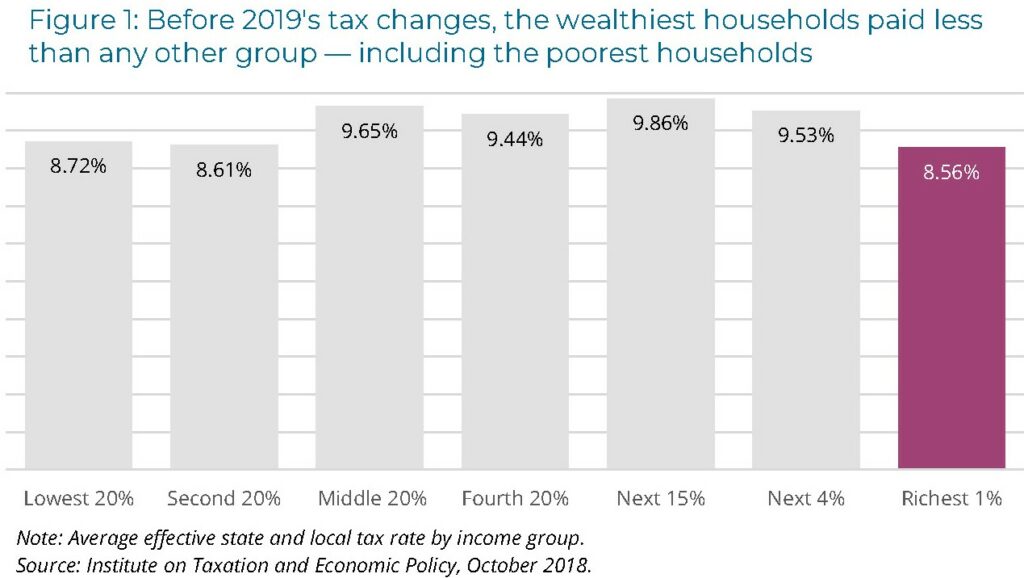

Maine Reaches Tax Fairness Milestone Itep

U S States With Highest Gas Tax 2021 Statista

State Alcohol Excise Tax Rates Tax Policy Center

Maine Reaches Tax Fairness Milestone Itep

Ultimate Excise Tax Guide Definition Examples State Vs Federal

State Sales Tax Jurisdictions Approach 10 000 Tax Foundation

Excise Tax What It Is How It S Calculated

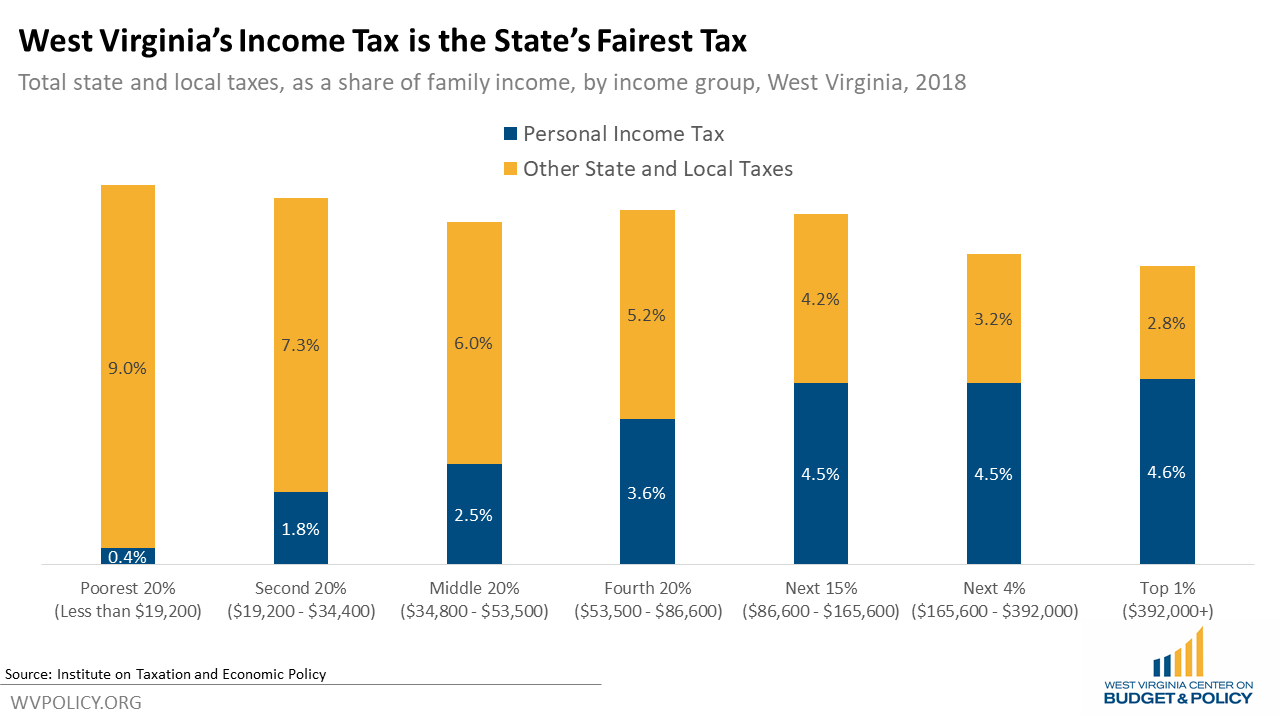

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy

Ultimate Excise Tax Guide Definition Examples State Vs Federal